billings montana sales tax rate

0 State Sales tax is -----NA-----. - The Income Tax Rate for Billings is 69.

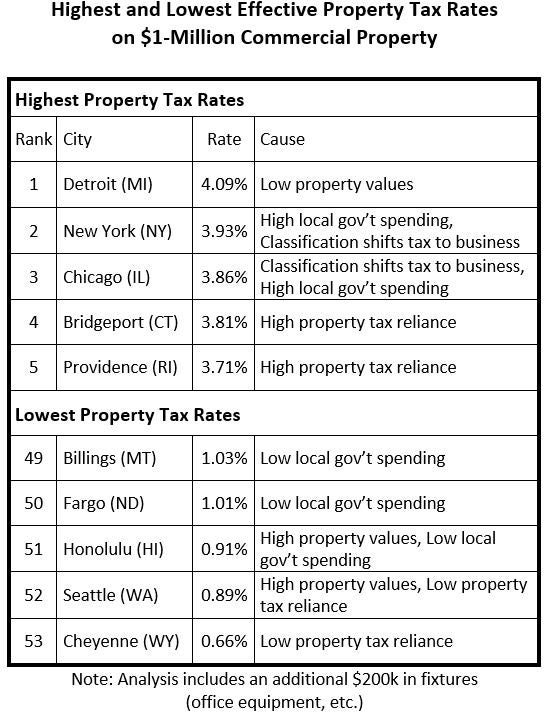

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

30 rows Tax Rates for Billings - The Sales Tax Rate for Billings is 00.

. Billings housing is equal to the national average. Butte-Silver Bow MT Sales Tax Rate. This means that the state does not collect any sort of sales tax at the state or local level.

The cost of living in Billings is 1 lower than the national average. Columbia Falls MT Sales Tax Rate. Additionally with no sales tax in the state of Montana Billings has become a very popular retail destination.

Montana general sales tax is 100 lower than the national average. There are additional taxes. Yellowstone County is located in central Montana and contains the city of Billings.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Billings MT at tax lien auctions or online distressed asset sales. The Montana sales tax rate is currently. The cost of living in Billings is 2 higher than the Montana average.

This is the total of state county and city sales tax rates. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special. Montana Individual Income Tax Resources.

The minimum combined 2022 sales tax rate for Billings Montana is. Montana charges no sales tax on purchases made in the state. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases.

Millage rates vary based on your location. Based on the DORs post hearing submission the ETR was determined by multiplying the 2001 mill levy of 42295 by the 2001 tax rate of 3543 42295 X 03543 15. 59107 zip code sales tax and use tax rate Billings Yellowstone County Montana.

Sales Tax in Billings Montana. The Billings sales tax rate is. Fortunately residents of Montana enjoy no sales tax.

Montana state income tax is 59 lower than the national average. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Great Falls MT Sales Tax Rate.

Real property tax on median home. These tax rates are taxes imposed per thousand of assessed value. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible.

Montana cities andor municipalities dont have a city sales tax and there are no local taxes beyond the state rate. Billings MT currently has 107 tax liens available as of March 20. However it has a moderately high 216900 median home value which causes its 1962 median annual property tax payment to rank as fifth-highest in the state.

Certain Tax Records are considered public record which means they are available to the public. Bozeman MT Sales Tax Rate. Montana has no state sales tax and allows local governments to collect a local option sales.

Exact tax amount may vary for different items. 59101 zip code sales tax and use tax rate Billings Yellowstone County Montana. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

Butte MT Sales Tax Rate. Tax Records include property tax assessments property appraisals and income tax records. 0 State Sales tax is -----NA-----.

Montana And Wyoming Rank In Top 10 For Taxes News Kulr8 Com District Of Columbia Sales Tax Small Business Guide Truic. Dillon MT Sales Tax Rate. Billings Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Billings Montana.

The December 2020 total. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0. The County sales tax rate is.

The proposed changes would result in state government becoming even more dependent on its 7 sales tax which is already its biggest revenue source and the second-highest rate in the country. The Billings Sales Tax is collected by the merchant on all qualifying sales made within Billings. The Montana sales tax rate is currently.

Billings MT Sales Tax Rate. The Billings sales tax rate is NA. Sales Tax and Use Tax Rate of Zip Code 59107 is located in Billings City Yellowstone County Montana State.

While many other states allow counties and other localities to collect a local option sales tax Montana does not permit local sales taxes to be collected. Tax rates in Yellowstone County are near the state average as its average effective tax rate is 090. The Billings Montana sales tax is NA the same as the Montana state sales tax.

Sales tax region name. The state sales tax rate in Montana is 0. Sales Tax and Use Tax Rate of Zip Code 59101 is located in Billings City Yellowstone County Montana State.

You would need to multiply this value by the. 4 rows The current total local sales tax rate in Billings MT is 0000. Determined the capitalization rate for the subject to be 99 with an effective tax rate ETR of 15.

An example of calculating your Montana property taxes is owning a property with an assessed value of 250000. Estimated Combined Tax Rate 000 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated. Montanas progressive state income tax system has a top rate of 69 property taxes are below the national average and there is no state sales tax.

Sales Tax State Local Sales Tax on Food. 2022 Montana state sales tax. Evergreen MT Sales Tax Rate.

Glendive MT Sales Tax Rate. Tax rates last updated in March 2022. The US average is.

Besides the applicable tax rate you must consider any applicable millage rates. AP South Dakota Senate Republicans on Friday rejected a proposal from the House to cut the sales tax by half a percentage point. The OAR for the subject was determined to be 114.

The 2018 United States Supreme Court decision in South Dakota v.

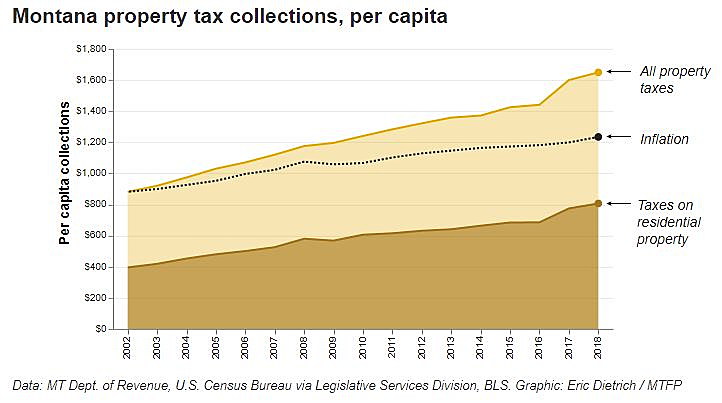

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

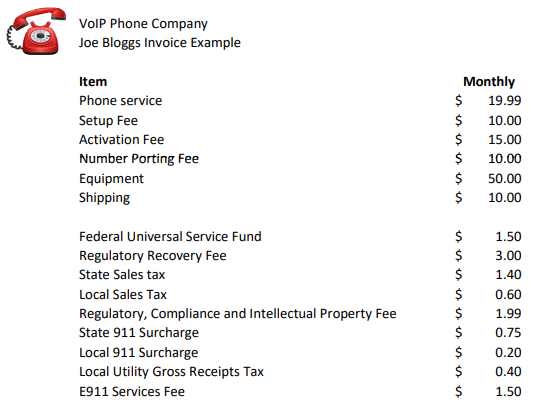

Voip Pricing Taxes And Regulatory Fees Explained

Montana Sales Tax Rates By City County 2022

Montana Income Tax Calculator Smartasset

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

Montana Income Tax Calculator Smartasset

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Best State In America Montana Whose Tax System Is The Fairest Of Them All The Washington Post

Montana And Wyoming Rank In Top 10 For Taxes News Kulr8 Com

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Sales And Use Tax Sales Tax Information Tax Notes

Wyo Property Tax Rates Rank Right At The Bottom Wyoming News Trib Com

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail