10 dollars an hour 40 hours a week after taxes

To calculate how much you make biweekly before taxes you would multiply 40 by 40 hours and 2 weeks. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with the equivalent monthly wages.

Disadvantages Of The Roth Ira Not All Is What It Seems

Dec 7 2010 0502 PM If I make 1000 an hour 40 hours a week how much will I net after taxes.

. This calculator is intended for use by US. Answer 1 of 8. 2810 dollars an hour is how much a year.

If you are paid 60000 a year then divide that by 12 to get 5000 per month. For example a person is paid time and a half for the hours worked between 40 and 46. More information about the calculations performed.

For example if you did 10 extra hours each month at time-and-a-half you would enter 10. 10 per hour 40 hours a week 50 weeks a year is 20000. 2810 Work hours per week.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Some taxes are paid by the employee some by you and some are shared between you and your employee. 40 hours of work per week multiplied by 52 the number of weeks in a year equals 2080 hours worked per year.

Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week. That makes a handy multiplier. Hourly non-exempt workers must be paid at least one and one-half times their regular rate of pay for any hours worked over 40 hours in a week.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 2400 after taxes. Multiply the total hours worked per year 2080 by 18 to get 37440. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 10 hourly wage is about 20000 per year or 1667 a month.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 1200 after taxes. Clothing Expenses Some jobs require workers to purchase and wear uniforms and these clothing costs will further reduce a persons real hourly wage. If you work 40 hours a week you will take home 1440 every two weeks.

It can also be used to help fill steps 3 and 4 of a W-4 form. His income will be. 40 an Hour is How Much a Week.

You will make 40 dollars an hour before taxes. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week.

Just take your hourly wage multiply by two and it gives you the number of thousands of dollars. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 10 hourly wage is about 20000 per year or 1667 a month. Hourly wage 2500 Daily wage 20000 Scenario 1.

Child Care 40 hours of child care a week reduces a workers real hourly even further sometimes by as much as 350 an hour. A graph or plot is included to give a visual representation of the earning and pay rates. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

If you work part-time or 25 hours a week making 18 an hour youll gross 1950 a month and take home about 1708 a month after taxes. If creating each item along with managing supply inventory interacting with customers then shipping the items takes her 2 hour then this comes to 10 per hour. If she sells about 2 items a week for 36 each spends 5 on shipping each item out has a 11 cost of goods for each item then her profit is 20 per item or 40 weekly on average.

But if you get paid for 2 extra weeks of vacation at your regular hourly rate or you actually work for those 2 extra weeks then your total year now consists of 52 weeks. If you know you work 40 hours a week for 50. Heres how we arrived at this number.

Multiply 188 by a stated wage of 20 and you get 3760. Assuming 40 hours a week that equals 2080 hours in a year. Your hourly wage of 10 dollars would end up being about 20800 per year in salary.

There city income tax. Wild guess 320 dollars give or take depending on. Two overtime rates are included for people being paid different overtime rates depending on how many hours are worked.

40 Work weeks per year. An employee receives a hourly wage of 15 and he works 40 hours per week which will result in the following earnings. To calculate how much you make biweekly before taxes you would multiply 20 by 40 hours and 2 weeks.

All the calculations above are based on the assumption you work 40 hours a week. If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiply it by 40 which means adding a zero behind the hourly rate then multiplying that number by 4. Paid a flat rate.

12 To calculate how much 2810 an hour is per year we first calculate weekly pay by multiplying 2810 by 40 hours per week. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 52 Income Tax Rate.

After 46 hours they are paid double their normal rate. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions. 18 an hour 40 hours a week is 1440 every 2 weeks before taxes.

Its not all bad news however. To calculate how much you make biweekly before taxes you would multiply 65 by 40 hours and 2 weeks. Weekly salary 60000.

All Topics Topic Science Mathematics If I make 1000 an hour 40 hours a week how much will I net after taxes. Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 3900 after taxes. If you make 2810 an hour then how much would you make in a year before and after taxes.

Enter the number of hours you work each week. A 40-hour week if you work 50 weeks a year assuming 2 weeks of vacation 2000 hours a year. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

20 an Hour is How Much a Week.

Day Trading Don T Forget About Taxes Wealthfront

10 000 After Tax 2021 Income Tax Uk

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

You Might Be Able To Retire To Beautiful Southern Italy Without Paying Taxes For 10 Years Travel Leisure Paying Taxes Southern Italy Best Places To Retire

2021 2022 Tax Brackets Rates For Each Income Level

Here S How Much Money You Take Home From A 75 000 Salary

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

New Jersey Nj Tax Rate H R Block

Australian Carbon Tax Actually Government Taxes Payroll Taxes Tax

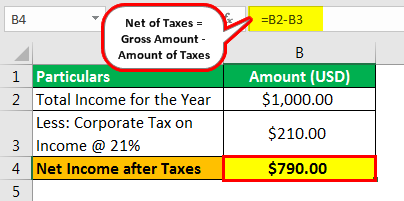

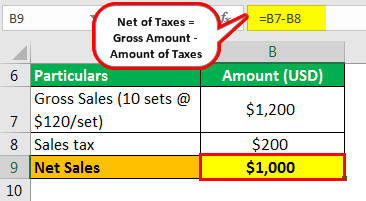

Net Of Taxes Meaning Formula Calculation With Example

Tumblr Entitlement Tax Human Services

How To Pay Little To No Taxes For The Rest Of Your Life

Net Of Taxes Meaning Formula Calculation With Example

Paycheck Taxes Federal State Local Withholding H R Block

10 000 A Month After Tax Us May 2022 Incomeaftertax Com

How To Pay Little To No Taxes For The Rest Of Your Life

Here S How Rising Inflation May Affect Your 2021 Tax Bill

How Much Do I Need To Make Hourly To Take Home 1 000 After Taxes Weekly Quora

Calculating Federal Taxes And Take Home Pay Video Khan Academy